Payroll System Malaysia

A structured payroll management solution ensuring salary accuracy, statutory consistency, and reliable workforce records for growing organizations in Malaysia.

What a Payroll System Means in Malaysia

In the Malaysian business landscape, a payroll system serves as the operational layer that translates employment agreements into accurate remuneration and documented workforce records. It ensures that employee wages, allowances, deductions, and adjustments are processed consistently based on predefined employment terms, rather than ad-hoc decisions.

Without a defined structure, organizations risk data discrepancies, record fragmentation, and internal disputes. A proper payroll structure supports broader HR services and workforce management by preserving clarity and traceability of all financial interactions with the workforce.

Furthermore, Malaysian payroll is heavily regulated by the Employment Act 1955, which mandates employers to provide itemized payslips and maintain detailed employment records for a specific duration. A structured system automates these requirements, significantly reducing administrative overhead and legal risks.

Payroll Structure and Processing Flow

Structured payroll processing begins with clear employee classification, defined salary components (such as basic pay, fixed allowances, and commissions), and approved compensation terms. Each payroll cycle follows a rigid workflow to record working hours, overtime (OT), and adjustments in a format that is fully auditable.

This structure enables organizations to verify payroll outcomes, identify anomalies, and maintain consistency across different departments. Integrating documentation discipline helps management ensure that every workforce-related financial decision remains aligned with internal HR policies and budget constraints.

Salary Accuracy

Consistent remuneration calculations aligned with documented employment terms to eliminate manual errors and calculation biases.

Centralized Records

Secure storage of all payroll documentation, enabling easy retrieval and traceability of historical workforce data.

Governance Control

Defined approval workflows and internal review structures ensuring every payment is authorized, legitimate, and accurate.

Payroll Governance and Internal Control

Payroll governance focuses on ensuring that remuneration-related decisions adhere to documented rules and formal approval flows. This includes defining authorization levels for salary changes, how adjustments are recorded, and how payroll data is validated before official disbursement occurs.

Clear governance supports management accountability and complements professional HR practices such as HR consulting. It often involves a “segregation of duties” approach to minimize the risk of fraud or unintentional errors within the financial ecosystem of the company.

Regular internal audits of the payroll system are essential components of corporate control, ensuring that statutory contributions (EPF, SOCSO, EIS, and PCB) are remitted on time and in accordance with the schedules set by Malaysian authorities.

Payroll Records and Workforce Traceability

Payroll records serve as critical long-term references for employment history, remuneration patterns, and workforce cost tracking. Organized documentation enables organizations to respond confidently to internal audits, management reviews, and inquiries from government agencies like LHDN, KWSP, or the Labor Department.

Maintaining clean and organized records strengthens overall workforce governance and ensures operational continuity even during staff turnover or transitions in organizational leadership.

Define salary structures, allowance categories, and company-wide payroll rules.

Execute payroll runs based on validated attendance, performance, and commission data.

Verify calculation accuracy and ensure all statutory contributions are correctly computed.

Securely store payroll documentation for a minimum retention period of 7 years.

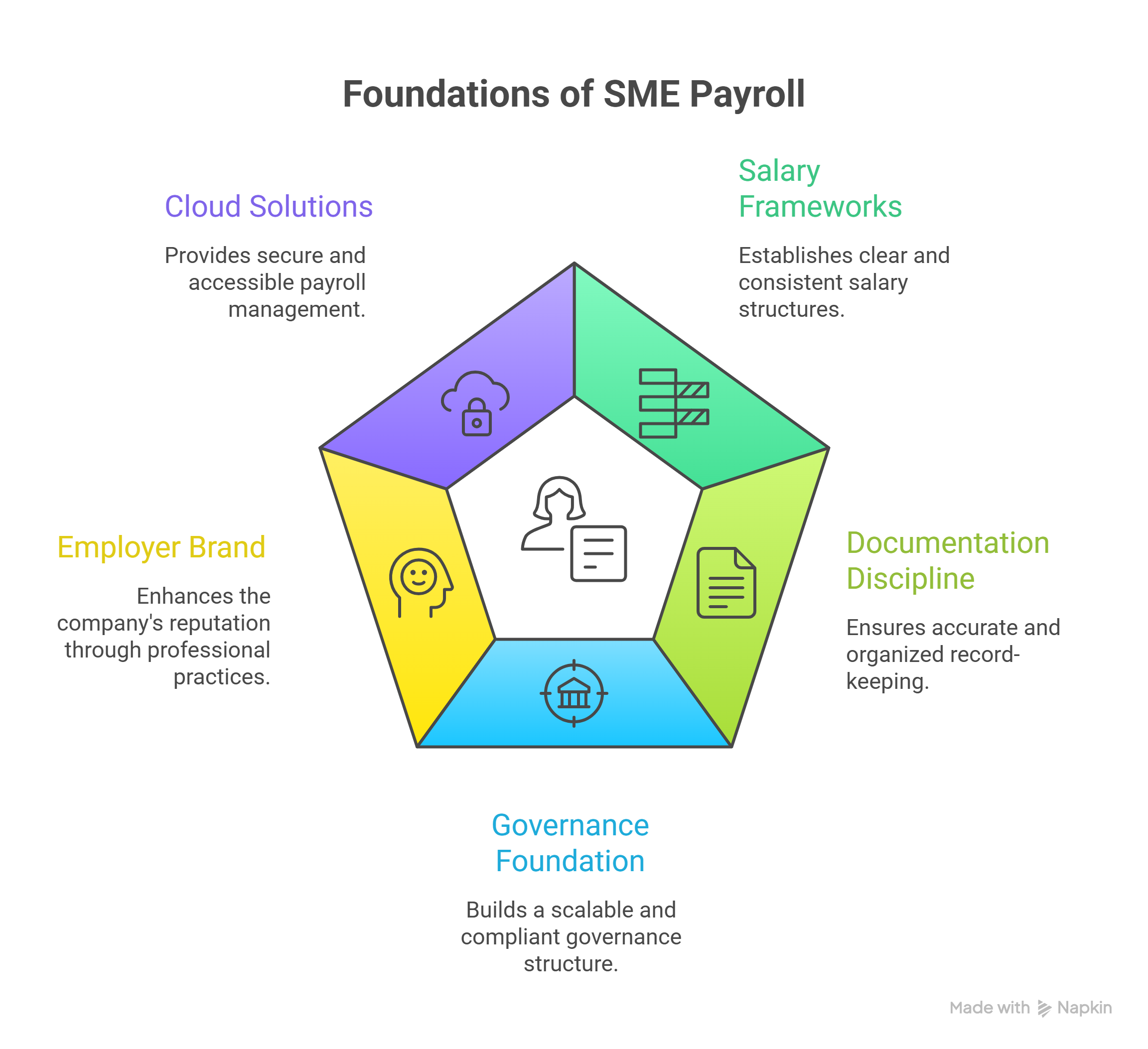

Payroll System for SMEs in Malaysia

For Small and Medium Enterprises (SMEs), a payroll system provides the foundational structure necessary during scaling phases. As the workforce expands, manual payroll management via spreadsheets becomes increasingly difficult and prone to high-stakes human error.

A structured system helps SMEs establish clear salary frameworks, maintain documentation discipline, and build a scalable governance foundation. This not only saves administrative time but also enhances the employer brand by ensuring employees receive professional payslips and timely statutory contributions.

Cloud-based solutions are particularly effective for Malaysian SMEs, offering data accessibility and security without the need for significant internal IT infrastructure investments.

Frequently Asked Questions (FAQ)

A payroll system manages salary processing, statutory deductions (EPF, SOCSO, EIS, PCB), and maintains systematic employee records according to Malaysian labor laws.

No, it also acts as a system of record for governance. it tracks salary history, allowance adjustments, and provides proof of statutory compliance for audit purposes.

While not strictly mandated to use specific “software,” the Employment Act requires accurate record-keeping. Automated systems are highly recommended to avoid penalties from manual errors.

In accordance with Malaysian regulations, payroll records and supporting documentation must be retained for at least 7 years for potential authority reviews.

Payroll systems document every cent of remuneration history and salary processing with professional-grade accuracy.

Payroll governance begins with establishing proper structures and documented processing rules. Build your HR foundation today.

Establish Your Payroll Structure Today

Build consistent payroll records that support your workforce governance and business scalability.

Explore Payroll Support